What is Jobs-to-be-Done

“Your customers are not buying your products. They are hiring them to get a job done.”

CLAY CHRISTENSENHarvard Business School

How Would You Beat Apple and Google?

A good way to test if a method and theory will work is to apply it to a real-world situation. Imagine you are the CEO of a portfolio company and your mission is to beat Apple and Google Maps? How would you do it? How would you implement the Jobs-to-be-Done framework? In the introductory video below, we demonstrate how a portfolio company could use Jobs Theory and our methods to beat Apple and Google Maps. This seems like an impossible task since Apple and Google have about 100% market share in this market. But it is possible by focusing on how and why customers struggle to get their job done when using Apple and Google Maps. This video includes detailed examples of how we use our method to create equity value for portfolio companies.

How to define a customer

Customers are the key to portfolio company success. Learn how we avoid lethal customer definition mistakes that result in competitors stealing a portfolio company's customers and market share.

TRADITIONAL APPROACH

A Customer Uses or Purchases A Product

To understand a portfolio company's market, defining the customers is critical. Who are the company's target customers? How should we define them?

Many tech companies define the customer as a "user" i.e. the person who uses their product. This seems to make sense because that's who they design the user experience for--the person who will actually interact with the company's product.

Another way to define customers is to use the dictionary definition: a person who purchases a product or service. This also seems logical, since getting someone to purchase a product is how a portfolio company generates revenue.

But the person who uses the product may not be the person who purchases it.

For example, an ultrasound tech in a healthcare facility is the user of an ultrasound machine, but they don't decide to purchase it. The purchasing responsibility belongs to a hospital administrator. Meanwhile, were ultrasound machines invented so techs could be employed? Probably not. They were invented because doctors needed to better diagnose a patient's condition.

Is the key customer the ultrasound tech using the machine, the hospital administrator who decided to purchase it, the doctor who uses the ultrasound images to learn about the patient's condition, or the patient?

Knowing who the key customer is and understanding them in-depth is key to determining their Job-To-Be-Done and defining the target market.

JOBS-TO-BE-DONE

Understanding A Market’s Three Types of Customers

The key customer in any market is the person who benefits from getting the job done. This is who we call the “job beneficiary.” The job beneficiary is the critical customer in a portfolio company's market because they have the most to gain from the job-to-be-done being satisfied by the company's product. The second customer to consider is the "job executor." This is the person who helps execute the job on behalf of the beneficiary. For example, IT managers help employees use business software. The third customer to consider is the purchase decision maker. For example, finance executives will often decide which software to purchase based on financial and budgeting considerations.

In consumer markets, the job beneficiary, executor, and purchase decision maker are frequently the same person. A consumer benefits from “getting to a destination on time.” They execute this job by driving themselves, and they make the decision to purchase products and services to get the job done.

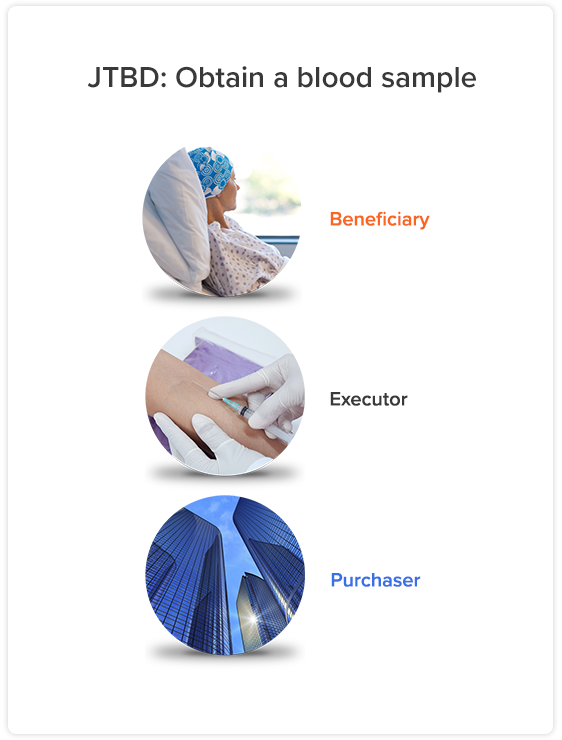

Medical markets are the most extreme example of the differences between job beneficiaries, executors and purchasers. Every medical product and service is ultimately designed to help patients. This is why medical markets exist: because patients need to get medical jobs done including optimizing their health, curing a health condition, and diagnosing a health condition. But patients rarely execute their own medical procedures and rarely purchase them on their own because they use insurance. For example, in order to obtain a blood sample to diagnose their health a patient (the job beneficiary) goes to a phlebotomist (the job executor) to get a blood sample, and the procedure is paid for by the insurance company (the purchaser).

We identify the distinction between beneficiaries, executors, and purchasers when building a portfolio company's product roadmap because targeting the wrong customers puts the company at risk that a competitor takes market share.

For example, before software-as-a-solution products, IT departments installed CRM software for salespeople. Salespeople use CRM systems to get the job done of “acquiring new customers.” Salespeople are the job beneficiaries in this market because they benefit from getting the job done with software. IT managers are the job executors who help salespeople acquire customers by installing and maintaining software. But once SaaS products were available, IT managers, the job executors, were unnecessary.

With our JTBD method, we map beneficiaries, executors, and purchasers in a portfolio company's market to ensure we target the right customers. This means that the job beneficiary and their needs decide what should be in the company's roadmap to create equity value.

EXAMPLE

Who is The Customer for Apple & Google Maps?

Let’s look at an example, with Apple and Google Maps. Who are the customers to target in this market? The underlying Job-to-be-done is to get to a destination on time. This example shows why creating customer personas to define customers is flawed. For example, a portfolio company may create two personas. Kate, is younger, urban with a college degree. Paul is older, rural, and has a high school education. Could these two very different customers with very different personas and characteristics both struggle to get to a destination on time in the same way?

The answer, of course, is yes. And the reason they each struggle has nothing to do with their persona characteristics. It has to do with the nature of how they execute the job. In this case, they both struggle to get to destinations on time because they both make frequent and unfamiliar stops. In other words, these two very different customer personas actually have the same unmet customer needs in this market. If a portfolio company defines its customers in this example using personas, they would miss a large segment of customers who are underserved and likely looking for a new product.

When we define customers for portfolio companies, we make sure to identify the three different customers: the job beneficiary, the job executor, and the purchase decision maker. In consumer markets, these are all often the same person. In complex markets, we identify all three. For example, in the medical JTBD of “obtaining a blood sample” the patient is the beneficiary, the phlebotomist is the executor, and the insurance company is the purchaser.

If a portfolio company were developing a product in the market for obtaining a blood sample and they target the phlebotomist, it creates risk that a competitor develops a solution for the patient (the job beneficiary) that enables them to take their own blood sample without a trained expert (the job executor). And this is exactly what is happening in this market.

Learn the JTBD Market Definition Technique:

.webp)

How to define a market

In business, the market always wins, so defining a portfolio company's market correctly is critical to success and equity value creation. JTBD shows that most companies get this wrong. Defining the market incorrectly can destroy equity value and ruin a portfolio company.

TRADITIONAL APPROACH

Products Define Markets

Defining a portfolio company's market using their product is very common. In fact, this is how it is taught in business school textbooks. But history is full of examples of product-based market definitions leading companies to build failed product roadmaps.

For example, Blackberry thought there was a market for keyboard devices and they built a product roadmap based on keyboards. Britannica thought there was a market for encyclopedias and built a product roadmap based on content for bound volumes of books. And Kodak thought there was a market for film and built a product roadmap based on improving the quality of film. At first product-based market definitions seem to make sense, since people were buying a lot of mobile keyboard devices, encyclopedias, and film.

But here is the flaw: products always change. This is a key concept in Jobs Theory: unlike products, the customer’s goal, their Job-to-be-Done, does not change. This is why we define a portfolio company's market and build their product roadmap using the customer’s job rather than their product. Because a JTBD is a stable target to hit.

JOBS-TO-BE-DONE

The Market Is The Customer's Job-To-Be-Done

Defining a portfolio company's market using the customer's Jobs-to-be-Done has profound implications for their product roadmap. Think of a product not as something a customer is buying, but as something that is helping them solve a problem or achieve a goal. In other words, a product helps them get their “job” done. This has been said in lots of different ways.

Clay Christensen of Harvard Business School, has said that “customers are not buying a product, they are hiring it to get a job done.” Theodore Levitt, also of Harvard, was famous for saying “customer’s don’t want a quarter-inch drill, they want a quarter-inch hole.” Steve Jobs said, that teams should “start with the customer experience and work back toward the technology.” And Thomas Edison said, “Anything that won't sell, I don't want to invent. Its sale is proof of utility, and utility is success.”

These are all the same idea. A customer has a goal to achieve or a problem to be solved. We now call the customer’s goal/problem a “job-to-be-done” or JTBD. Customers “hire” a portfolio company's product to help them achieve the goal, solve the problem, and get the job done. There are big advantages to defining the market and building a portfolio company's product roadmap using the customers JTBD. First and foremost, the customer’s JTDB doesn’t change over time. Second, we can prioritize where the customer struggle the most to ensure we build and launch features that help customers overcome their struggle. And third, the portfolio company's team doesn’t have to use opinions about product ideas in the roadmap. Using the customer's JTBD, we objectively quantify how each idea helps the customers get their job done faster and more accurately.

EXAMPLE

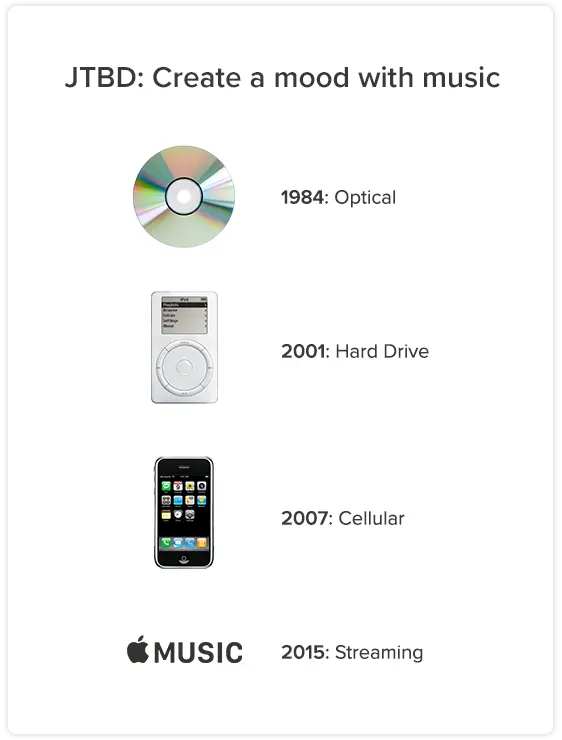

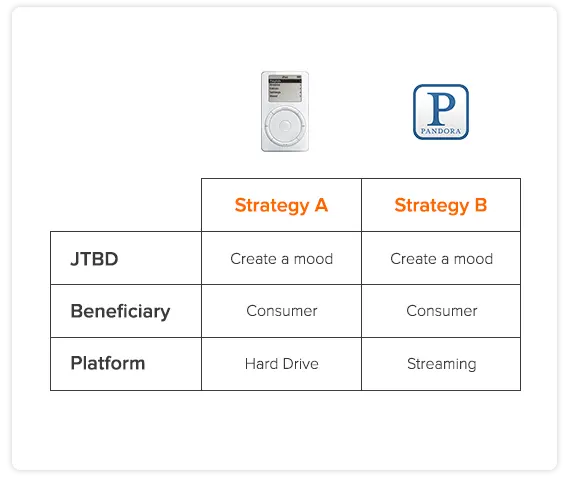

Firing iPods, Hiring Streaming Services

Let’s look at an example. In order to execute the job of “creating a mood with music,” consumers have "hired" a huge range of products: piano rolls, Victrolas, LPs, eight-track tapes, reel-to-reel tapes, cassettes, CDs, MP3 players, and streaming apps. If you define the job with reference to the technologies or products customers have used, you will be trying to hit a moving target. But the job of creating a mood with music has never changed and will never change. The customer's JTBD gives us a stable target to hit when we build a portfolio company's product roadmap.

In 2006, Microsoft thought there was a huge opportunity to take share in the “iPod” market. This product-based definition of the “iPod” market led Microsoft to create a product roadmap for the Zune. And it was a total failure. They lost nearly $300 million in one quarter alone. Why did the Zune fail? Because there is no such thing as an “iPod” market. The true market is the customer’s job of “creating a mood with music.”

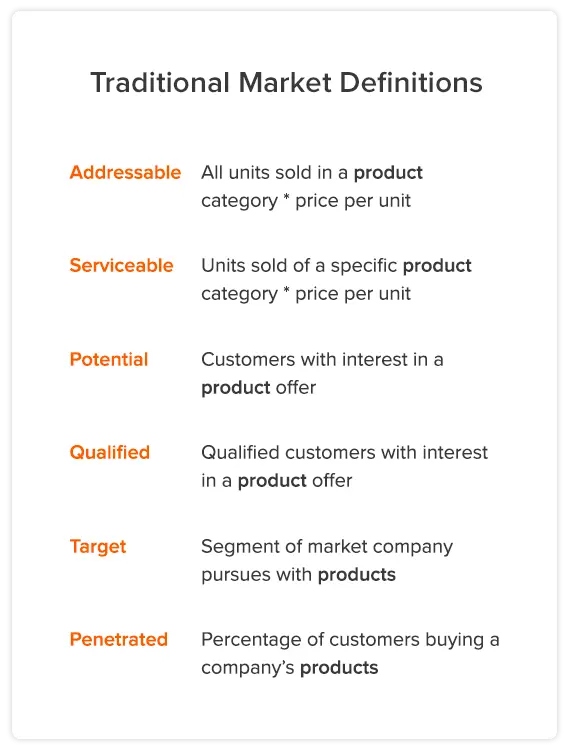

You can see how Microsoft's fatal mistake was defining (and then sizing) the market based on the traditional market definitions listed here, which all use a product as a critical element. Because the market definitions are based on a product, we redefine them using the customer's JTBD.

We all fired records and hired CDs. Then we fired CDs and hired iPods. Then we fired iPods and hired streaming services. Why? Because the true market is to create a mood with music and each new product got the job done faster and more accurately than the previous. As JTBD shows, the new products were hired because they satisfied unmet customer needs better than the competitive solutions. This is why building a product roadmap using the customers JTBD is so critical. Because it will leads a portfolio company's team to build features that get the job done faster and more accurately than competitors.

Learn the JTBD Market Definition Technique:

See a Real-World Example:

Market Sizing

Calculating the size of a portfolio company's market and growth opportunity accurately is extremely important. Companies that size their market incorrectly risk missing opportunities to accelerate growth and create equity value. History is littered with dead companies that made fatal market sizing mistakes.

TRADITIONAL APPROACH

Product Price Times Number of Buyers

Almost all traditional market sizing equations use the price of the product as a key variable. For example, the Total Addressable Market (“TAM”) is often defined as the number of buyers times the price of a product. Why is this a mistake? Because customers are not actually “buying” a product, they are “hiring” it to get a job done. As a result, the size of a portfolio company' market opportunity is based on the customer’s willingness to pay to get their job done better, regardless of the price of the product. This is why companies like BlackBerry, Britannica, and Kodak failed when they invested in the wrong product roadmaps. They sized their markets (and thus projected their revenue from their roadmaps) based on the price of their products. How much are you willing to pay for a roll of film or a set of 26 encyclopedias today? Probably $0 because these are both obsolete products that don't get the job done as fast and accurately as today's solutions.

JOBS-TO-BE-DONE

The Customer’s Willingness to Pay Is The Market Size

The foundation of our JTBD method is that customers are not buying a product, they are hiring a product to get a job done. Every product in history has been replaced by a new product that got the customer’s job done better. A portfolio company's product will be too. Defining the market based on the customer's JTBD lowers the risk that a portfolio company's product roadmap fails to generate the revenue growth to create equity value.

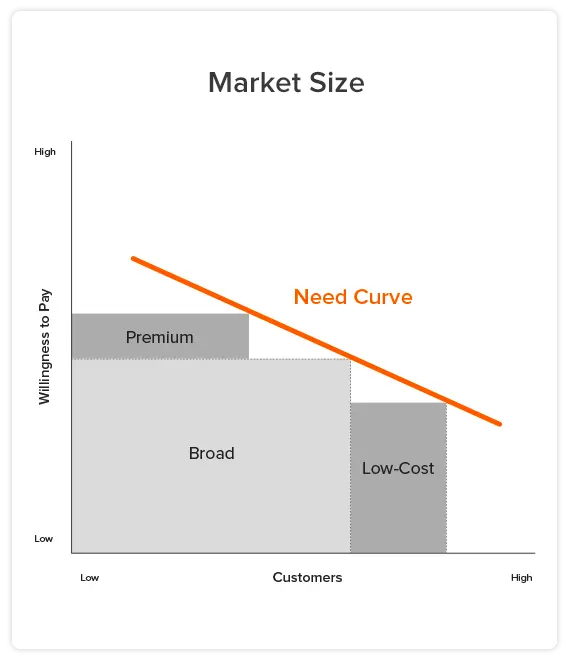

To size a market opportunity, we don’t analyze the products currently in the market. Instead, we define the portfolio company's market as a goal customers are trying to achieve (a job-to-be-done). We identify the range of the customers’ willingness to pay to get their job done using a quantitative survey that asks the right market sizing questions. We plot this range of willingness-to-pay on a chart from low to high. We call this the Need Curve because it looks like a traditional economics demand curve, but instead of plotting price and quantity of product, it plots the number of customers willing to pay to get their job done. The area under the Need Curve is the size of the portfolio company's market.

By using our Jobs-to-be-Done method to size a. portfolio company's market, we justify investments in the product roadmap to ensure that we accelerate growth and create equity value through. product innovation. Instead of launching products into markets that are about to disappear, we focus on stable markets and where the portfolio company can win. And we increase the probability that the portfolio company's product roadmap investments will accelerate growth, generate multiple expansion, and create equity value.

EXAMPLE

From $30 Billion to $0

Our market sizing chart shows how the need curve can be used to size a portfolio company's market. It plots different values for customer willingness to pay. The area under the curve is the size of the market. The need curve will be unique in each portfolio company's market, and it will reveal the true size of the market growth opportunity. It is a more accurate way to determine how much revenue and profit growth a portfolio company can generate in the target market.

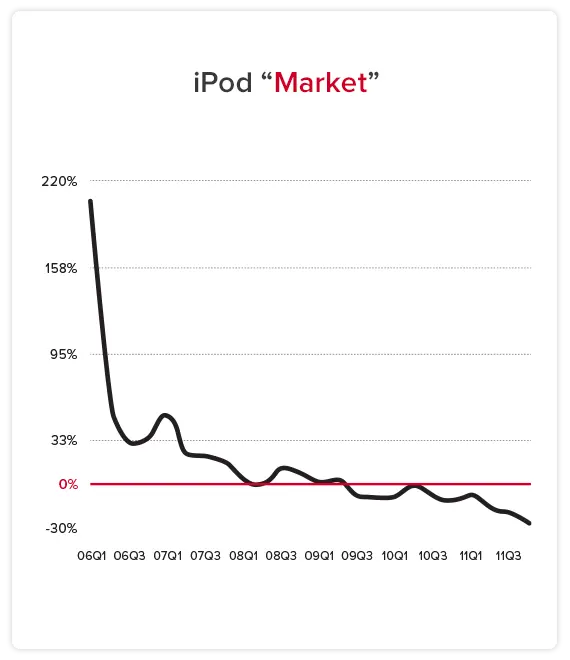

Let’s look at an actual example of a fatal market sizing mistake. In 2006, Microsoft thought there was a big opportunity to launch an iPod competitor. They calculated that Apple had sold 200 million iPods at about $150 each. So, using traditional market definitions and market sizing calculations, this was a $30 billion market, which is very large, even for Microsoft. They built a product roadmap of features to compete with the iPod, which even included, ironically, a “podcasting” feature.

The team felt they had a product roadmap that could win because Microsoft had hundreds of millions of existing customers. And their iPod competitor, the Zune, could connect to their Windows operating system, which was by far the dominant operating system in the world. They built their product roadmap and launched the Zune. It was, of course, a tremendous failure. They lost $300 million in one quarter. And within a few years, Apple’s iPod revenue was effectively $0.

What happened? Did the market go away? Of course not. People are creating a mood with music in larger numbers today than ever before. This is because the JTBD, and thus the true market, is to create a mood with music. In this market, like in all, markets, the leading product, the iPod, became obsolete just like all of the products before it: records, cassettes, and CDs. When a new product emerged (streaming apps) that got the job done faster and more accurately, customers switched to the new product. This happens in every market. This is why we use the customer's JTBD and their willingness to pay to get the job done as the foundation for the product roadmaps we create for portfolio companies. It minimizes the risk that a portfolio company builds a failed product like the Zune.

Learn the JTBD Market Sizing Technique:

Customer Needs

Satisfying customer’s needs better than competitors is the key to building a portfolio company's product roadmap. But most companies and product teams don’t agree on what a customer need even is. This is a serious problem that our JTBD method helps solve.

TRADITIONAL APPROACH

Ask Customers What Product They Want

Portfolio company teams almost never agree on how to define a customer need. Research has shown that 95% of all companies do not have an agreed-upon definition of a customer need. Without an agreement on customer needs, portfolio companies often ask customers about what products they want. This is a mistake. Why? Because customers can’t envision what great product should result from the company's roadmap. But they can absolutely explain what problem the product needs. In other words, customer's can explain how they struggle to get their job done.

For example, a portfolio company could ask 1,000 consumers what products they want and they would likely never come up with the microwave. Customers don’t have the technical expertise to understand what makes a microwave work. But they can tell you everything about preparing a meal (a JTBD) and how they struggle. This is true in every portfolio company's market too: the customers can explain their struggles, if they are asked the right questions.

JOBS-TO-BE-DONE

A Customer Need Is an Action and a Variable in the Job

In our JTBD method, a customer need is clearly defined. This enables a portfolio company to communicate in the same way, using the same language when creating and building the product roadmap to accelerate growth.

A customer JTBD is a goal they need to achieve, independent of any product. For example consumers don’t “want” records, cassettes, or iPods. They want to “create a mood with music.” This is the job-to-be-done. In every JTBD, there are a set of steps that a customer has to take in order to complete that job and achieve the goal. And within each job step, there are actions a customer has to take using variables in the job.

These actions and variables are the customer needs, and like the JTBD they are independent of any solutions. The customer actions in a need are defined by action verbs (e.g. determine, identify, gather, calculate, reduce, ensure, etc.) and the variables are defined by job. For example, in the job of “getting to a destination on time,” the variables include, arrival time, departure time, travel time, the route, alternative routes, traffic, weather, errands, stops along the way (e.g. errands or fuel), etc.

Most JTBDs have 10 to 20 steps and 50 to 100 customer needs. In other words, while the customer’s JTBD is complex, it is knowable. And because the JTBD and the customer needs are independent of any product or service, the customer’s needs are stable over time and will not change. This is the power of our JTBD method: when we create and build a portfolio company's product roadmap, we are aiming a stable customer target that does not change over time.

EXAMPLE

How To Identify Customer Needs

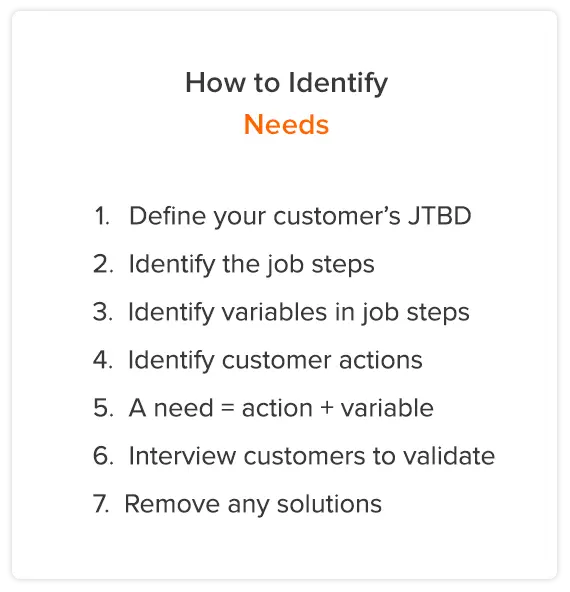

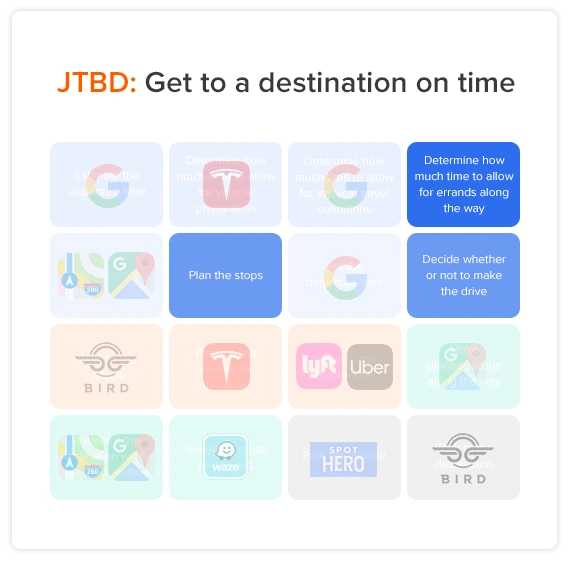

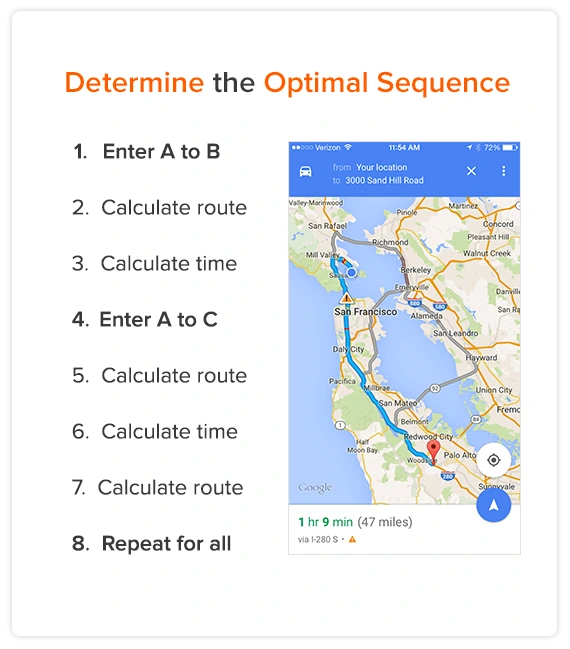

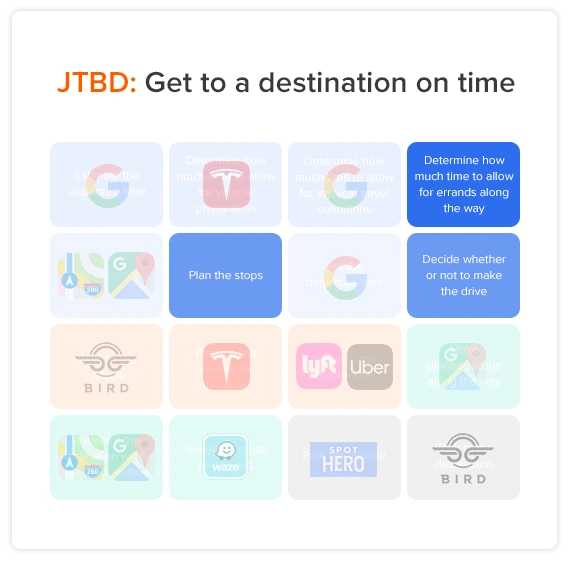

Let’s look at an example of how we identify customer’s needs for portfolio companies. Imagine a product team trying to beat Apple and Google Maps. The first step is to identify all the needs in the customer’s job of “getting to a destination on time.” This is to ensure that the product roadmap is results in a product that people want and is better than your competitors -- in this example, Apple and Google Maps.

To identify customer needs, we start by identifying the steps in the customer’s JTBD. Job Steps outline what the customer needs to accomplish to achieve the goal (ie. get the job done). And Jobs Steps fall into six categories: understanding steps (i.e. understanding the job or the problem), planning steps (i.e. planning to get the job done), execution steps (i.e. taking actions to achieve the goal), assessing steps (i.e. monitoring how well the job is going while executing it), revision steps (i.e. making changes to get the job done better), and conclusion steps (i.e. ending the job successfully).

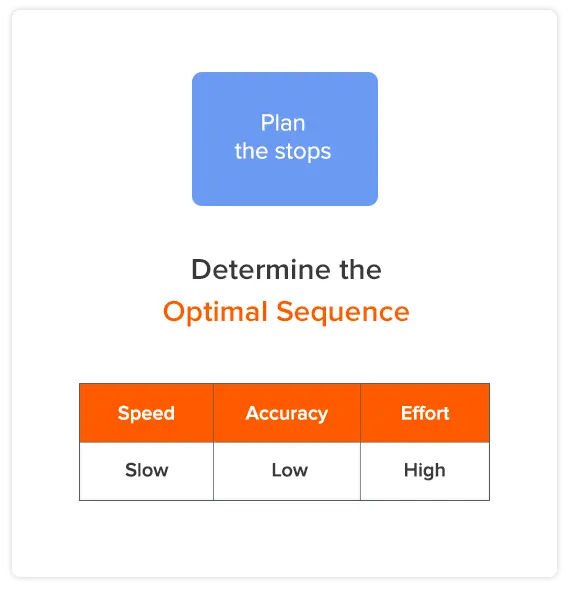

All jobs follow this job step pattern. For example, getting to a destination on time follows this pattern: An understanding step is to “estimate the departure time.” A planning step is to “plan the stops.” An execution step is to “travel to the destination.” An assessment step is to “assess if the destination will be reached on time along the route.” A revision step is to “reset the route as needed.” And a conclusion step is to “park the vehicle.” The technique we use to determine job steps is to ask customers about what process they use to get the job done (i.e. achieve their goal). We can ask them about the steps to understand the goal, plan and prepare to achieve the goal, etc.

Once we have identified all the steps in the customers' Jobs To Be Done, we identify the customer needs in each step. We ask customers what makes executing each job step difficult, time-consuming or inaccurate. We listen for the variables in the JTBD. For example, when consumers plan stops to get to destinations on time, they have to know variables including the routes to the stops, the optimal sequence of stops, and the open times at the stops. And with each variable, the customer has to take an action. For example, when planning stops a consumer has to determine the optimal sequence of stops.

Since customer needs are metrics, we survey the portfolio company's customers to identify how much effort it takes them to satisfy their needs. The level of struggle is a Customer Effort Score (CES). If it is too difficult, the effort is high, and the CES is therefore high. We create customer value (and as a result equity value) for portfolio companies by making it easier (faster and more accurate) for the customer to satisfy their needs with the company's product.

Learn the JTBD Customer Needs Technique:

.webp)

Unmet Needs

Satisfying unmet customer needs with features in a portfolio company's product roadmap is the fastest path to equity value creation. Our JTBD method prioritizing unmet needs in the portfolio company's roadmap to target the most underserved customers who are more likely to buy.

TRADITIONAL APPROACH

Product Complaints

Portfolio companies often do market research to figure out what their customers want. These methods include NPS (net promoter scores), customer opinions about product features, or trends like emerging technologies (e.g blockchain or AI). But there are critical flaws in these methods: they don’t focus on the customer’s struggle to get their job done independent of any product, service, or technology. The iPod had very high NPS scores, but this didn’t help Microsoft launch a successful competitor because it didn’t show them where customers were struggling to “create a mood with music” (the JTBD).

If portfolio companies customers about products, they will give answers about products. This is what Henry Ford meant when he famously said “If I asked customers what they wanted, they would have said a faster horse.” Instead of asking customers about the portfolio company's product (or a competitor’s), we ask them about their struggle to get their job done. This is how we identify unmet customer needs, and segment customers based on their unmet needs. This is the key to creating equity value for a portfolio company through product innovation.

JOBS-TO-BE-DONE

Quantify The Customer’s Unmet Needs with a Survey

Our method of defining customer needs is powerful because it is quantifiable. Every customer need in a customer’s JTBD has an action and a variable that are independent of any product. For example, no one needs the “Add a stop” feature in Google Maps. What they need is to “determine the optimal sequence of stops.” In this example, “determine” is the action and “optimal sequence” is the variable. And in every JTBD, the customers want to get their job done as fast and as accurately as possible. As a result, we measure the speed of a customer’s action and the accuracy of the variable in every need.

In order to determine which customer needs are unmet, we conduct a customer survey and ask customers if it is difficult for them to satisfy the need today. For example, how difficult is it for consumers to determine the optimal sequence of stops in their day? If it is difficult, consumers will tell us in the survey. And if a high enough percentage of customers say the need is difficult to satisfy, then the need is an unmet customer need. This makes sense because customers who struggle (i.e. who say it is difficult to satisfy the need) are the ones most likely to buy the features we build in a portfolio company's product roadmap that satisfy the need faster and more accurately (i.e. with less customer effort). You can think of our survey results (i.e. the percentage of customers who struggle) as the probability that customers buy what we build in the portfolio company's product roadmap.

EXAMPLE

Using Unmet Needs to Beat Apple and Google Maps

If a portfolio company were building a product to beat Apple and Google Maps, they would want to know where customers struggle the most. In a survey, 86% of consumers said that determining the optimal sequence of planned stops in a busy day was difficult with Apple and Google Maps. It is not hard to see why this is true.

For a busy person with multiple meetings, appointments, and errands throughout a day, determining the optimal sequence using Apple Maps or Google Maps would require entering destination A, calculating the time and the route to destination B. Then entering destination A, calculating the time and the route to destination C, comparing the two A to B and A to C routes, determining which was quicker and repeating the process for every possible combination of destinations.

With Apple Maps and Google Maps satisfying the need to determine the optimal sequence of planned stops is manual, time-consuming and likely highly inaccurate. It is not surprising that 86% of consumers said it was difficult. This is the power of our JTBD method: we have a quantifiable unmet customer need we use in the portfolio company's product roadmap. The probability that consumers adopt the portfolio company's new product innovation to satisfy this need is high if it helps them overcome their struggle.

We do this analysis for every need in a customer's JTBD to ensure that a portfolio company's product roadmap is focused on satisfying unmet needs better than its competitors.

Learn the JTBD Unmet Needs Technique:

Product Strategy

Every product roadmap is the result of a product strategy. Choosing the wrong product strategy can be fatal for a portfolio company. Just ask all the failed companies throughout history.

TRADITIONAL APPROACH

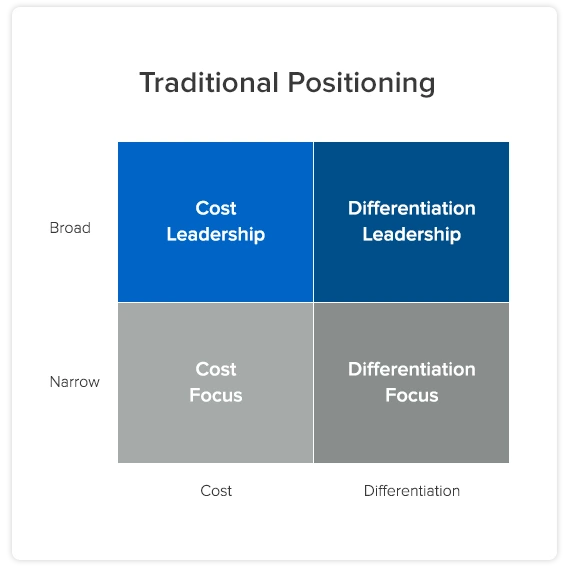

Performing Activities Differently from Competitors

A product strategy is a plan for a portfolio company to beat competitors. How do companies create a strategy? In 1996, Harvard Business School Professor Michael Porter wrote a famous paper called “What is Strategy?” Companies often use Michael Porter's definition of strategy, since he was a pioneering academic in the field, famous for analyzing industries to determine competitive strategy. In Porter's view, “The essence of strategy is choosing to perform activities differently than rivals do.” Activities can include manufacturing, engineering, distribution, marketing, and selling.

What is missing from these “activities” is the customer. This is why Porter’s definition is outdated: he didn’t include the customer’s job-to-be-done in his definition of strategy. The customer’s needs, not the portfolio company's activities, are the focus of the product strategy we create for a portfolio company. Customer do not care about a company's activities. They care about getting their job done.

JOBS-TO-BE-DONE

A Product Strategy Is The Choice of a Target Customer, JTBD, Segment, and Unmet Needs.

Creating a successful product strategy for a portfolio company includes making four choices.

First, which customer are we going to target? As we said explained above, markets evolve to remove job executors as customers when job beneficiaries can get more of the job done on their own. Targeting the job beneficiary with a product strategy is a stable, long-term choice. In some markets, job executors are still critical to getting the job done because the technology cannot yet get the job done without them. In this case, we might choose to target the job executor to create short-term growth. The key is to understand the risks of the target customer decision and to align the portfolio company's team with a clear target customer to create focus.

Second, which job-to-be-done are we going to target? The customer’s job is the market. Choosing an underserved job that customers are willing to pay to get done better is the foundation of a product strategy to create equity value.

Third, which customer segment will the portfolio company focus on? We focus the company on a group of customers who struggle significantly with the job, have unmet needs we can satisfy, and are willing to pay enough to get the job done better that we can accelerate the company's growth by only focusing on this segment.

Fourth, which unmet needs will the company's product, marketing and sales teams focus on? Prioritizing the unmet needs in the target customer segment is the key to accelerated growth and faster equity value creation.

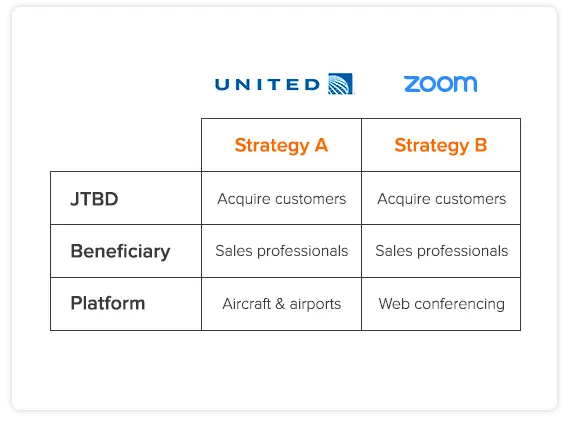

EXAMPLE

Airlines vs. Video Conferencing, Zune vs. Pandora

Our JTBD method to create a product strategy is very powerful because it can reveal unseen competitive threats. For example, United Airlines likely doesn’t think that video conferencing is a strategic threat. But when we analyze one of the airline's most important customers, salespeople, and analyze their job-to-be-done, threat becomes clear. Salespeople are hiring airlines to acquire customers. They can also hire video conferencing to get the same job done. The unmet needs each company chooses to target in this job will drive the designs of their solutions and which salespeople choose which solution. If video conferencing satisfies all of the needs better, it will take this profitable customer segment away from airlines.

Which one will win? The coronavirus pandemic and lock down just accelerated what was already happening. Web conferencing is getting better (and will continue to get better) at helping salespeople acquire customers without the need to get on a plane. These customers are very valuable to airlines, so web conferencing is a serious competitive threat to airlines.

Our JTBD product strategy method is also effective when analyzing products that changed over time. Microsoft and Pandora had the same product strategies, targeting the same customer (consumers) and the same JTBD (create a mood with music). But Microsoft chose the same solution platform as the iPod (a hard drive device), while Pandora chose a different platform (streaming to apps). The product roadmap for Microsoft’s Zune resulted in a $300 million loss in one quarter alone, while Pandora’s product roadmap helped them grow to 90,000 new users per day. In this example, a streaming platform clearly satisfied the unmet needs in the job faster and more accurately. If Microsoft had a clear JTBD strategy in focus instead of trying to take share of a product-defined market (MP3 players), it may have recognized that the Zune would not satisfy needs in the job any better than the iPod and streaming would satisfy needs much better. This is the key to our JTBD strategies: putting a portfolio company's focus on customers' unmet needs in the job helps us make product roadmap decisions that leapfrog competitors.

Learn the JTBD Customer Technique:

Competitors

To help a portfolio company beat its competitors, we identify where they get the customer’s job done slowly and inaccurately. Using our JTBD method, we help portfolio companies beat even the biggest competitors in the world.

TRADITIONAL APPROACH

Feature-to-Feature Comparisons

In traditional competitive analysis, portfolio companies often compare their own product's features to a competitor's features. If Product A has all of the features of Product B plus a few more, then Product A has the advantage. In this traditional view, more features equals more competitive advantage.

Focusing on feature-to-feature comparison is the wrong way to think about competitive differentiation. Why? Because customers don’t want more features, they want a product to help them get their job done faster and more accurately. Microsoft’s Zune had more features than Apple’s iPod, yet it failed to take any meaningful share of the market because it didn’t get the job done faster or more accurately. Streaming services (like Pandora and Spotify) actually had fewer features, but they got the job of “creating a mood with music” done much faster. Pandora only had one end-user feature: click play to listen to music for the mood. Pandora’s algorithms did the rest for the customer.

Portfolio company's often build roadmaps for feature catch-up to competitors. It's like bailing water out of a leaky boat: every time the company releases a feature and think their work is done, the competition releases something new, racing ahead yet again. The portfolio company will always be a step behind.

JOBS-TO-BE-DONE

We Identify Competitor Weakness Using Unmet Needs

A portfolio company's customers are analyzing competitor products almost every day. When they struggle to get their job done, customer look for new competitive solutions to get their job done faster and more accurately. In our JTBD method, a competitor is any solution that helps get a job step done. This approach is how we identify competitors in each customer job step, as opposed to relying on industry-based competitors.

Competitive weakness is satisfying a need slowly or inaccurately. Since needs are structured with an action and a variable, we measure the speed of the action and the accuracy of the variable when customers use a competitor’s solution. We use our JTBD analysis to analyze not only the portfolio company's competition, but also the company's existing product in order to identify where it needs to be improved. As a result, we add those improvements to the portfolio company's roadmap before a competitor attacks and takes market share by getting the customer's job done faster and more accurately.

EXAMPLE

Planning Stops With Apple and Google Maps

Imagine a portfolio company was trying to build a product to beat Apple and Google Maps. How should the portfolio company analyze these products to figure out what features to put in their roadmap?

People hire maps applications to “get to destinations on time.” One of the job steps is to plan the stops. And if someone has a busy day with multiple stops, he or she needs to determine the optimal sequence of stops to make sure they stay on time with meetings, appointments and errands.

“Determine the optimal sequence of stops” is a customer need in this job-to-be-done. It has an action (determine) and a variable (the optimal sequence). To analyze Apple and Google maps, we assess the speed and accuracy of determining the optimal sequence using those products.

If a user were to try to determine the optimal sequence of stops using Apple or Google Maps, it would take multiple steps. For example, a user would enter destination A, enter destination B, calculate the route and time, repeat for destination A to C, re-plan if going from A to C first was faster and less variable, and repeat this process for all possible combinations of stops. This manual process is very slow and the accuracy is low if the user could even successfully determine the optimal sequence at all.

This is a weakness in Apple and Google Maps. We do this analysis with a portfolio company's competitors (and their product) to identify where the customers struggle to get their job done with the competitive solutions in the market. A competitive solution is anything that helps a customer get a job step done and satisfy customer needs in the job. In the image on the left, you can see all the steps in the job of getting to a destination of time, each with a competitor overlaid on the job step. This helps a portfolio company visualize their competition, and it reveals which job steps have fewer competitors.

Segmentation

To accelerate a portfolio company's growth and and create equity value through product innovation, we identify the most underserved segment of customers in the market.

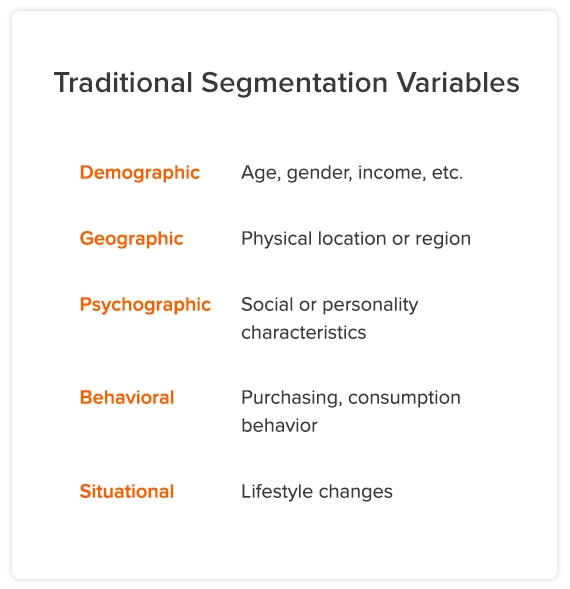

TRADITIONAL APPROACH

Demographic characteristics

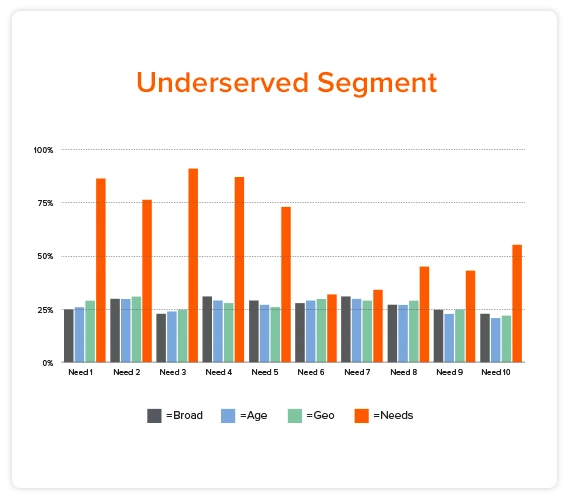

Portfolio companies often use traditional segmentation characteristics like demographics (age, zip code, gender, etc.), psychographics, purchase patterns, or industry verticals (in B2B markets). But this almost never works because characteristics like age and zip code do not determine if customers struggle to get a job done. In our JTBD segmentation method, we use the customer’s unmet needs to identify the most valuable segment, regardless of their characteristics.

For example, “getting to a destination on time” is a JTBD (it is a goal consumers need to achieve independent of any products). Could an urban woman with a Ph.D. struggle to get to a destination on time the same way a younger, rural man with a high school education? Yes, of course. And the reason they both struggle is not because of their demographics or characteristics, it is because they both struggle with something specific, like making frequent and unfamiliar stops.

JOBS-TO-BE-DONE

We segment customers using needs in their job

The core idea in our JTBD method is that a customer’s struggle to get their job done is what causes them to make a purchase. The most valuable customer segment for a portfolio company to target is the group of customers who struggle the most and are willing to pay the most to get their job done better.

Customers buy new products because they struggle to get a job done at a price they are willing to pay, regardless of their characteristics like demographics, geography or psychographics. Our JTBD segmentation method identifies the group of customers in the portfolio company's market who struggle the most and who are willing to pay the most to get the job done better. This ensures that the company's product roadmap has a higher likelihood of success because it targets the customers who need it new product innovations most.

Most importantly, with our JTBD method we collect proprietary data for our customer segmentation. In a our JTBD surveys, we generate quantitative insights into which customer segments struggle the most, how many customers are in the segment, and how much they are willing to pay to get the job done. Using profiling questions, we segment customers by profiling characteristics as well. This most often reveals that the customer struggle is not different across profile-based segments. The good news is that because of our survey, we data that identifies the struggling customer segment, independent of their profiling characteristics.

EXAMPLE

Who struggles the most to get their job done?

Let’s look at an example. Imagine a portfolio company is trying to beat Apple and Google Maps. Which users of Apple and Google Maps would most likely switch to a new product? Using traditional segmentation characteristics doesn’t tell you who these customers are. But when we survey people who need to get to destinations on time we generate proprietary customer effort scores that quantify which customers struggle the most. The underserved segment is the group of customers with the highest customer effort scores (i.e. the most unmet needs in the market). We then create personas of these underserved customers using their unmet needs. For example, the customers who would most likely switch to a new product from Apple and Google Maps are customers who make frequent and unfamiliar stops. They struggle to plan their stops (a job step) and they struggle to determine the optimal sequence of stops (a customer need). And they are willing to pay for a new solution that satisfies their unmet needs. We now have identified a valuable customer segment, and if we build a product to satisfy their unmet needs faster and more accurately than Apple and Google Maps, there is a high probability that they will buy and use the new product.

So who are the customers to target in this market? Who struggles to get to a destination on time? This example shows why creating customer personas to define a portfolio company's target customers can be flawed. Could two different customers with very different personas and characteristics, both struggle to get to a destination on time? The answer, of course is yes. And the reason they each struggle has nothing to do with their persona characteristics. It has to do with the nature of the how they execute the job. In this case, they both struggle to get to destinations on time because they both make frequent and unfamiliar stops. In other words, these two very different customer personas actually have the same unmet customer needs in this market.

Learn the JTBD Customer Technique:

Idea Generation

A portfolio company's product ideas to build and launch are critical to success and equity value creation. What is the best way to generate and analyze product ideas for the company's roadmap before making the big investments in product development?

TRADITIONAL APPROACH

Brainstorming

To facilitate the generation of new ideas, portfolio companies often rely on brainstorming. And in those brainstorming sessions, there is often only one rule - there are no bad ideas. In other words, the company's team is not supposed to use any criteria to judge new ideas on the assumption that this will enhance creativity.

Often new product ideas can come from customer requests, sales team requests, stakeholders, or new technologies. The possibilities are endless, which is the problem. The reason traditional brainstorming is inefficient is because there are no objective criteria to quickly and efficiently judge new product ideas.

JOBS-TO-BE-DONE

We direct the ideation process with customer needs

When generating product ideas for portfolio companies, we use the customer's unmet needs to quickly evaluate competing ideas using speed and accuracy. We start with the product strategy, which puts the key customer, the target segment, and the unmet needs in focus. We generate new ideas to satisfy the target unmet needs faster and more accurately than competitors in the market.

Once we have a need in focus, we assess the speed and accuracy of competitor solutions to set the benchmark the new product idea has to beat to get customers to switch from their current solution to the portfolio company's new solution.

We then assess the speed and accuracy with which the new product ideas will help customers satisfy the target needs. If a new idea is faster and more accurate in concept, we know it’s worth further examination. We assess the cost and risk and test working prototypes with customers to confirm they perceive the value the value of how the product idea gets their job done.

EXAMPLE

Which idea will beat Apple and Google Maps?

To continue with our Apple and Google Maps example, if a portfolio company were to generate and evaluate product ideas to beat competitors, we would start with the customers' unmet needs. The unmet needs are the criteria to judge any idea the portfolio company may have. Before generating or evaluating product ideas, we start with a detailed description of the customer we are targeting (in this example, drivers), the job they are trying to get done (e.g. get to destinations on time), the undeserved job step in the segment (e.g. plan the stops) and the unmet need (e.g. determine the optimal sequence of stops).

With the job step and the unmet need in focus, we generate and analyze ideas. For example, let’s say we had two competing product ideas to satisfy the need to “determine the optimal sequence of stops.” The first idea is an Assistant Service where a user calls a virtual assistant and gives them access to their calendar. The assistant would look up the relevant traffic information, construction information, event information, weather, etc. around the destinations for the date and time of the meetings. The assistant would then make changes to the calendar. The second idea is Sync and Optimize, where the user syncs their calendar to an app that uses relevant information inputs and optimization algorithms (e.g. “traveling salesman” algorithms) to determine the optimal sequence of stops to keep users on time for their meetings. This is the process to generate and analyze product ideas in order to determine which ones will create the most customer value before investing in new product development. Now that we. have multiple product ideas that target unmet customer needs, we use speed and accuracy to determine which one will create the most customer value.

Learn More About JTBD Idea Generation:

Customer Value

Creating customer value is the key to your team's success. Products that create more customer value take share from competitors and win in markets. But what is customer value, and how is your team measuring it? How should you use customer value to prioritize your roadmap?

TRADITIONAL APPROACH

Using NPS and satisfaction scores as a proxy for customer value

In traditional methods, companies use Net Promoter Scores (NPS), satisfaction, and other metrics to help determine the customer value of the product. While NPS and satisfaction may give your team data about your customers’ view of your product, they don’t identify where your customer is currently struggling. In other words, because NPS are focused on your product, they don’t identify your customer’s unmet needs. The iPod, for example, had extremely high NPS and satisfaction scores, but that did not help identify the opportunity for streaming services, which now dominate the industry and ultimately killed the iPod as a platform for creating a mood with music (the job-to-be-done).

Traditional methods don’t give your team insight into why customers are dissatisfied or how you can add more value. In addition, if you’re launching a new product that hasn’t been used by customers, how can you determine if it will provide value to customers?

JOBS-TO-BE-DONE-THEORY

Calculate a product feature’s speed and accuracy

The ultimate goal for a portfolio company is to satisfy your customer’s needs better than competitors in the market. This is what accelerates growth and creates equity value. The customer’s struggle to get their job done (i.e. their struggle to achieve their goal independent of a product) is what causes them to purchase a new solution that generates portfolio company revenue. So customer value is providing customers with a solution to overcome their struggle faster and more accurately than competitors.

Customer value is created when a product helps customers get their job done with less effort. To mitigate the risk of product failure, we measure customer effort and customer value before investing a portfolio company's capital in product development. A product innovation creates customer value when it gets the job done faster and more accurately. And speed and accuracy are metrics we measure even before we invest in product development. If our new product idea is not significantly faster and more accurate, we keep iterating the idea. Once we have created product ideas with significant customer value, we prioritize these in a portfolio company's roadmap.

EXAMPLE

iPod vs. Zune vs. Streaming

Let’s look at the iPod example again. In 2006, the iPod dominated the world of MP3 players. iPods came to dominate because they helped consumers create a mood with music faster and more accurately than the CDs which they replaced. For consumers to create a mood with music (the JTBD) with CDs, they had to travel to a music store like Tower Records, browse CDs, purchase a CD, play a song on the CD, switch to another CD to play a similar song from a different artist for the mood. They could record the songs from CDs to cassettes, which had a limited amount of time, about 90 to 120 minutes of music. When CDs dominated the world of music, you could measure the speed and accuracy of getting the job done. The whole process could take hours, even days, and because consumers had to buy whole CDs to get just one song they liked, it was not very accurate when creating a mood with music.

Apple’s marketing message for the iPod was “1,000 songs in your pocket.” And like all innovation that succeeds, the iPod got the job done faster and more accurately. With the iTunes Store, consumers could browse and preview songs for the mood they were creating. This made getting the job done more accurate and lower cost because they didn’t not have to buy whole albums when they only wanted one or two songs by the artist. And it was much faster because they could buy songs from the iTunes store without any travel to a traditional “brick and mortar” retail location.

In 2006, Microsoft launched the Zune, an iPod competitor. The Zune is an excellent example of a product that did not create any customer value. In other words, it worked almost exactly like an iPod. A user visited an online store, purchased and downloaded songs, and synced those songs to their Zune. If Microsoft had analyzed the customer value of the Zune using speed and accuracy, it would have been obvious that they should not invest in its product development because it was not faster or more accurate than its competition.

But streaming services, starting with Pandora and eventually Spotify. Took a different approach. A consumer didn’t need a dedicated device to create a mood with music, and they didn’t even have to purchase and download songs. Pandora enabled a user to select an artist or song for the mood, click play and listen to an almost limitless number of songs for the mood. Their algorithms were very good at identifying the mood and a user could refine the algorithm by simply clicking thumbs up or down for each song. Clearly streaming services were faster and more accurate than the iPod and the Zune. When the Zune launched, Pandora was signing up 90,000 users per day, and streaming services now dominate the music industry.

Learn our JTBD method:

Product Roadmapping

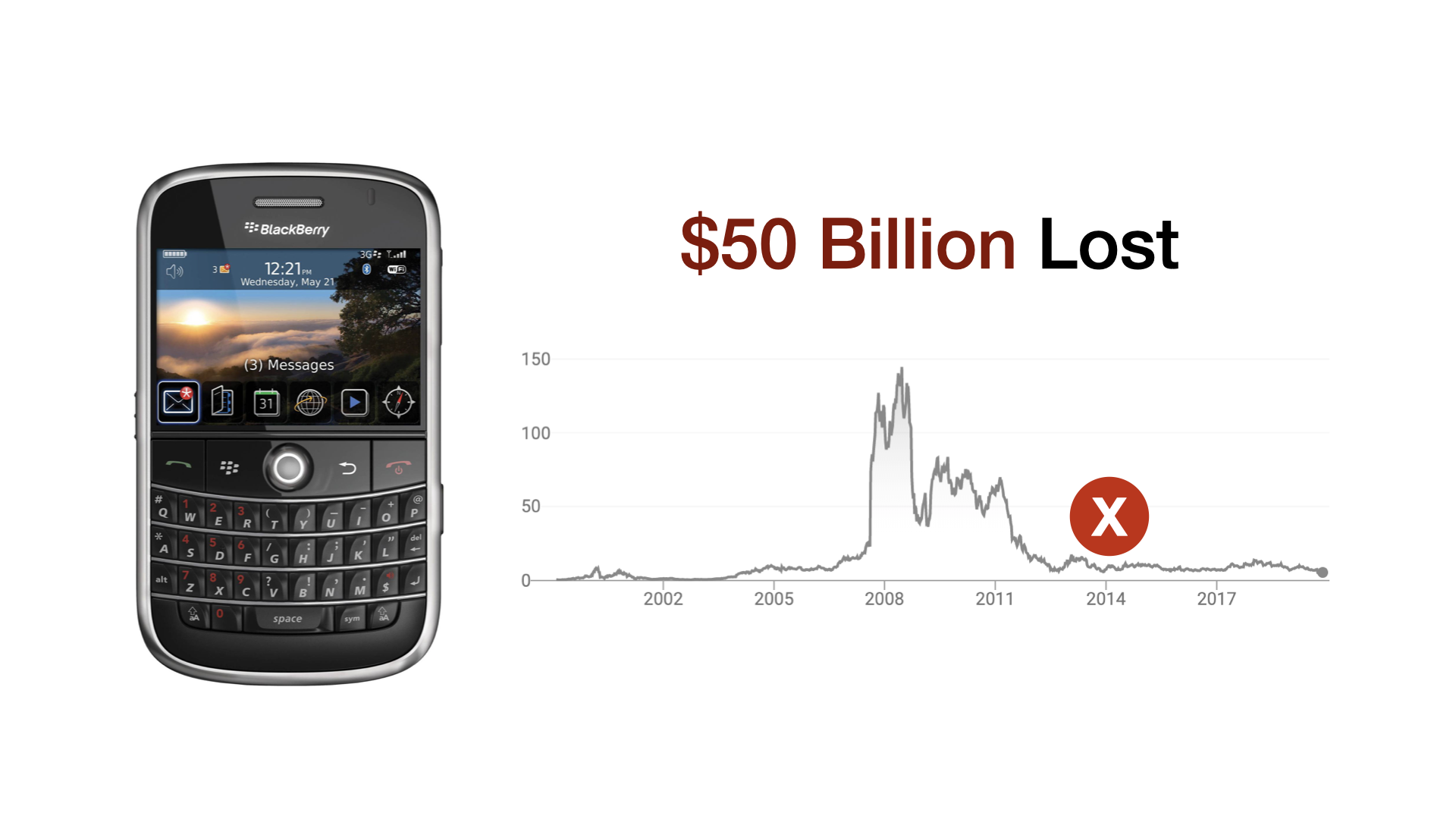

Prioritizing features on a portfolio company's product roadmap is the key to beating the competition, accelerating revenue growth, and creating equity value. The Blackberry and the iPhone both had product roadmaps. One led to the destruction of $50 billion, the other led to the most successful product and company in the history of business.

TRADITIONAL APPROACH

Gather requirements from stakeholders

Traditionally portfolio companies aggregate feature ideas from the company’s customers and stakeholders. Prioritization of features can become a political battle between personalities on the company's team because there are no objective customer criteria to serve as the basis for the company's roadmap decisions. In short, the portfolio company should not prioritize it roadmap, the customers should. Blackberry failed because they did not understand the unmet customer needs in their market, and as a result, they prioritized their product ideas (about improving a keyboard-based device), rather than prioritizing feature ideas that would satisfy unmet customer needs faster and more accurately.

JOBS-TO-BE-DONE-THEORY

We prioritize product roadmaps by using unmet customer needs

To prioritize a portfolio company's product roadmap, we first create the product strategy, making clear choices about:

- The target customer

- The job-to-be-done we will help the customer get done

- The underserved target customer segment

- The size of the customer segment

- The probability of generating the revenue growth to create equity value

- The unmet needs we will satisfy to get the job done better than competitors

Having the strategy in focus gives us objective criteria to judge the ideas on the portfolio company's roadmap.

Next, we assess everything on the company's roadmap in light of the product strategy.

We categorize backlog items as follows:

- Tech Debt

- Customer Commits

- Maintenance/Bug Fixes

- On Strategy Product Ideas

- Off Strategy Product Ideas

Different portfolio companies have different names for each of these categories but every roadmap has some version of them. The goal in our assessment is to determine what percentage of the company's resources are allocated to each category and if that allocation will achieve the growth goals and create equity value.

We ensure that a portfolio company's is allocating the necessary resources to On Strategy Product Ideas. To determine if an idea is on strategy, we answer the following questions related to the strategy:

- Does the idea help the target customer segment get the job done?

- Does the idea satisfy a need for a high priority job step in the strategy?

Customer Commits and On Strategy Product Ideas are not mutually exclusive. A customer request for a feature could fit well with the strategy.

But, we assess if the customer feature requests that are off strategy for they portfolio company. They can help the company get short-term revenue, but they can throw the company far from growth strategy and cause them to miss the biggest opportunities to create equity value in the market.

EXAMPLE

Blackberry over-allocated resources to customer commits

Blackberry is an example of a company that likely allocated a tremendous percentage of their resources to customer feature requests, but they missed the unmet customer needs that could be satisfied without a keyboard, faster and more accurately with a touch interface. Because they were focused on their product (a keyboard device) and customer requests about improving that device, they missed the opportunity to prioritize their roadmap based on the unmet needs in their customers’ jobs-to-be-done. As a result, Blackberry failed to capitalize on the biggest market opportunity in the history of business.

Learn the JTBD Customer Technique:

Positioning

Creating a unique and clear position in the market for a portfolio company's product is extremely important. It helps differentiate from competitors, convey a unique value proposition to customers, and create equity value faster. Good positioning makes it easier for customers to make the decision to buy the portfolio company's product.

TRADITIONAL APPROACH

Position a product by its features

When portfolio companies create a positioning strategy, the often use traditional methods (for example as explained by Harvard’s Michael Porter). These methods define market position using cost or feature differentiation and broad or narrow customer focus. Accordingly, portfolio companies choose to be the low cost solution or a feature differentiated solution. If the company are focused on being the low cost solution, competitors can copy the company's operational effectiveness as best practices disseminate in the industry. If a company positions its product based on feature differentiation, it will supposedly help differentiate the product enough so that customers are more likely to buy it. However, what happens when a competitor comes along and highlights the same set of features and benefits? The company is then constantly be playing catch up, trying to compete with similar products.

JOBS-TO-BE-DONE-THEORY

Position to the job steps and unmet customer needs

It can be a struggle for a portfolio company to come up with a unique position in a crowded market. However, we use our JTBD method to create a positioning plan that connects with customers quickly. The key difference in our JTBD positioning is that we don't use the product features to position the brand or product. Instead, we look at the steps a customer takes to get a job done and focus on those steps that are the biggest struggle for customers. In other words, those steps that have unmet customer needs.

EXAMPLE

Positioning against Apple and Google Maps

As an example, if a portfolio company were competing with Apple and Google Maps, they would face two competitors with almost 100% market share, almost limitless resources, and built in competitive advantages (because their maps applications are included for free with their platforms). It would be very hard to position and compete on cost when the competitors are free. How should a portfolio company position against them in order to differentiate? The customer's JTBD in this market is to “get to destinations on time.” This JTBD has 16 different steps, including “planning the stops.” Our JTBD analysis shows that there is a large segment of underserved customers who struggle to plan their stops because they make frequent and unfamiliar stops. Positioning to this job step is an effective way to target these underserved customers and differentiate from Apple and Google Maps because their solutions do not quickly and accurately help customers plan their stops and determine the optimal sequence of stops in a busy day with unfamiliar destinations.

Learn the JTBD Customer Technique:

Messaging

The best product in the world won’t generate growth for a portfolio company if no one knows about it. We craft messaging that resonates with unmet customer needs in their job-to-be-done to convert leads to customers.

TRADITIONAL APPROACH

More features and technology are better

Comparing features and specs across competitors is everywhere. We’ve all seen the table that shows a bunch of features down the left and then checkmarks for each competitor who has each feature. More features is better, right? The problem is customers don’t know what features they want, but they know what problems they want to solve. As Henry Ford put it, “If I asked customers what they wanted, they would have said a faster horse.” The horse riders know they want to get to their destination faster but they don’t know what features and technologies will make it happen. This is also true today. For example, telling customers that a product has AI does not help them understand why that’s valuable.

JTBD THEORY

Message to the emotions of getting the job done better

We help portfolio company's generate empathetic messaging. Empathizing with customers means recognizing that customers don't want to use the company's product features, they want to get their job done so they can get back to their lives.

The trick is to include 3 elements:

- The job the product helps customers get done

- The functional and emotional struggle with getting the job done that the product helps them overcome

- A demonstration of how the product helps them overcome their struggle quickly and accurately

In other words, we create messages that let customers know that we understand their problems and that show how product helps them solve it.

We have used our JTBD messaging method improve marketing effectiveness 10x over product and feature-based messaging.

EXAMPLE

Kodak Brownie

At the end of the 19th century, photography was extremely onerous. Not only did you have to take the picture, you had to develop it using a wet plate collodion process, which was as hard to do as it is to say. It was a time-consuming and sensitive process involving large equipment and mixing chemicals, largely left to experts. In 1900, Kodak launched the Brownie with the slogan “You press the button, we do the rest.” Not only was the product a major innovation in terms of improving the speed and accuracy of preserving a memory, but the message was a classic example of telling the customer the product will get the job done for them and relieve them of anxiety.

Learn the JTBD Technique: